Where Does All That Money Go?

Hey smart ladies, so we all know how hard we work for our money right? We work 40+ hours a week to top up that bank balance. But at the end of some months (or weeks) do you ever sit down and cannot figure out where it all went? I used to have such moments in figuring out what comes in and goes out. Initially, I thought I was good in sticking to my “budget” (now I put that in quotations because I never had a formal budget just a vague idea that some money should go here and some should go there). Then my electricity bill would arrive or I would need to buy petrol and suddenly my account balance showed $2…HOW?

After having enough of those embarrassing moments and relying on my trusty credit card to pick up the slack, I took the time and talked to some finance savvy friends, listened to a few podcasts, and did some personal finance soul searching, NOW I can tell you how it happens. Think of this like when you first start a new diet, you think that you are eating really well and treat yourself occasionally but you are good overall. Then comes weigh in day and you discover you haven’t lost anything or even worse you have gained weight and it’s all come down to those “occasional” treats that added up to a full bag of “Gummi bears”, a packet of “Tim Tams” and a bag “Doritos” in a week.

The same principle applies to your money. It is the “occasional treats”… -(those coffee and cake dates with the girls you had last week; the take-out you had last night; the cute top you got at the store on a whim 2 weeks ago), that add up to a heck of a lot of money and just like that bag of “Gummi bears” stopped me from reaching weight loss targets, these untracked expenses played a big role in stopping me from reaching my savings goals.

For me, I tackled my fiances the way I tackled my diet. The first step to figuring out how to fix my problem is figuring out where the problem was- where exactly DID all my money go?

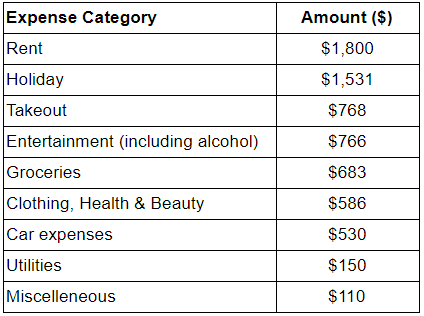

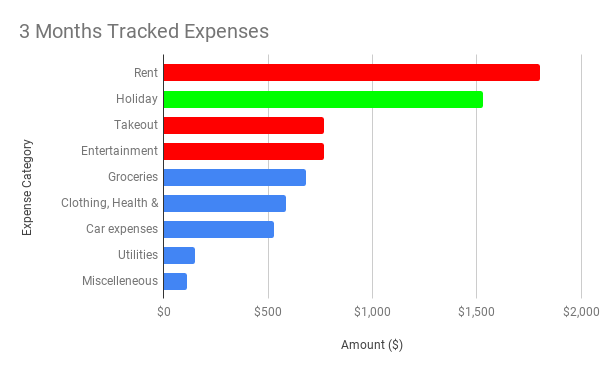

For a start, this self-professed techno-bimbo went old school. I got a paper copy of my last 3 months statement from the bank and I sat down with different coloured markers, then highlighted my different expenses. I calculated how much I had spent from each category and I was astounded by what I found for the 3 month period:

Once I had this information, I could see immediately where I could cut down on my expenses- the takeout ($768) and entertainment ($766). I was spending an average of $511 of my hard earned money every month on junk! Likewise, my grocery budget was equally ridiculous- this was for a single person!!!!

I could focus my efforts on making change where it would make the most consistent difference. I started meal planning and eating at home, challenging myself to weeks of not buying groceries and eating out of my fridge and pantry. I even invited friends over for potluck dinners (where everyone brought one meal that we shared together) instead of going out to a restaurant.

If you are serious about reaching your financial goals, you need to be brutally honest with yourself.

Surprisingly, I found this to be a great way to do that… there was no escaping from all the highlighted takeout food for me. I knew that if I wanted to save my money I have made those cuts. It wasn’t easy and I am still mortified at how much money I was wasting, but without that raw

DARE TO CHALLENGE YOURSELF

My challenge to you today is this. Go and get your bank statement (either online or paper form), sit down (by yourself or with a partner or friend if you need an accountability buddy), and go through it. Highlight top 4 – 5 areas where you spend your hard earned money and then write it down just like I have done above… Is there anything that stands out to you or surprises you? Any obvious places to start making changes to your budget? Let me know what you find and how you go, I love hearing from you guys (via E-Mail or Facebook or Instagram)